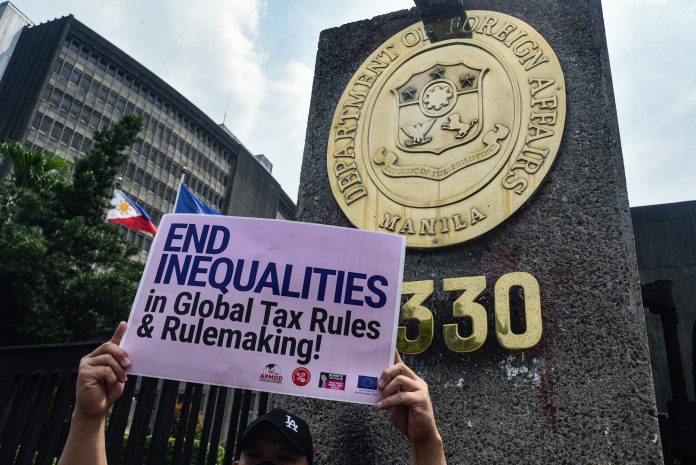

A coalition of Asian civil society organizations is rallying for just, equitable, and progressive international tax reform through the United Nations Tax Convention.

More than 40 grassroots organizations across Asia have delivered an open letter titled “UN Tax Convention Now: A Call for Urgent Tax Justice” to key Philippine institutions, calling on governments in the region to support global tax rule changes aimed at curbing an annual revenue loss of $480 billion due to tax abuse, primarily by multinational corporations and the wealthy.

The groups said the call to action comes as part of the Asia Days of Action for Tax Justice – a week-long initiative organized by the Tax and Fiscal Justice Network Asia (TAFJA) to raise awareness and mobilize support for a more equitable international tax system.

The open letter underscored the far-reaching consequences of these losses, emphasizing that they directly impact the provision of public services at a time when the costs of essential goods and services continue to rise.

The coalition emphasized the importance of redirecting profits gained by large corporations and affluent individuals back into society through progressive taxes, including wealth taxes, and the elimination of regressive taxes such as Value-Added Taxes (VAT).

Paradibs Cortes, Eastern Visayas coordinator of Sanlakas, said the massive profits that large corporations and wealthy individuals “have gained through the exploitation of tax systems” should be directed back to ordinary people.

The Asia Days of Action for Tax Justice coincided with the opening of the 78th Session of the General Debate of the UN General Assembly, where member states are expected to discuss the options for a UN Tax Convention.

This convention, based on the Option 2 model (framework convention on international tax cooperation) proposed by UN Secretary-General António Guterres, aims to establish legally binding principles and structures for international tax governance.

Civil society organizations contend that this approach is more democratic, inclusive, and transparent compared to the Base Erosion and Profit-Shifting (BEPS) Framework.

The BEPS Framework, led by the world’s largest economies through the Organization for Economic Co-operation and Development (OECD) and the Group of 20 (G20), has drawn criticism from civil society groups as “illegitimate, undemocratic, and exclusionary.”

They argue that it reinforces existing biases in the international tax system, benefiting multinational corporations and the Global North while leaving Global South countries at a disadvantage.

Pillar One of the BEPS Framework allocates the right to tax multinational corporations’ excess profits to their home countries rather than the countries where they operate, depriving Global South nations of much-needed revenue.

Pillar Two sets a minimum global corporate income tax rate of 15%, lower than the global average of 25-30%, potentially leading to a race to the bottom in corporate tax rates among Global South countries.

Lidy Nacpil, coordinator of the Asian People’s Movement on Debt and Development, said the multiple crises “have highlighted the critical need to fix the broken and unequal international tax system. Now is the time for comprehensive, just, and equitable changes”.

The open letter called on governments in Asia and the Global South to resist the inclusion of the BEPS Framework’s Two-Pillar Solution in the upcoming UN Tax Convention.

The groups urged governments to work toward the implementation of just, fair, and progressive tax policies to meet the needs and rights of their citizens during times of deepening crises.

All Photos by Angie de Silva