An ecumenical youth group Tuesday lambasted the signing of the Maharlika Investment Fund (MIF) into law, which will use state assets for investment ventures.

“Instead of addressing calls for substantial and material policies such as wage increase, genuine agrarian reform, and response to the education sector, Marcos Jr. resorts to two-faced policies and gambling of public funds,” said Kej Andres, national spokesperson of Student Christian Movement of the Philippines.

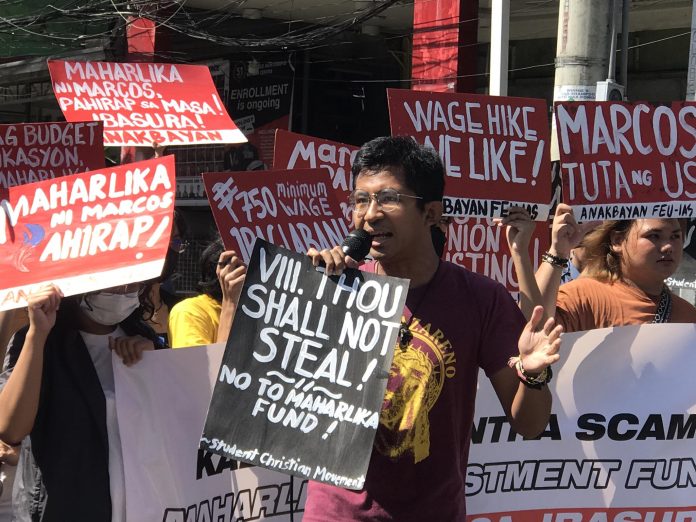

The group July 18 staged a protest against the measure in Manila coinciding with the signing of the bill into law by President Ferdinand Marcos Jr. in Malacañang Palace.

Marcos had pushed Congress for swift approval of the bill, which was filed by his son and cousin late last year.

During a signing ceremony at the presidential palace, Marcos said the fund would “leverage a small fraction” of the government’s money without adding to the country’s debt burden.

“We will leverage on a small fraction of the considerable but underutilized investable funds of the government and stimulate the economy without the disadvantage of having additional fiscal and debt burden,” Marcos said, less than a week before he is due to deliver his second State of the Nation address.

The 500-billion-peso investment fund will draw most of its funds from the national government, including the central bank, gaming revenue and two state-owned banks.

Andres expressed concern over its “transparency” since the president has the power to appoint the people who will manage the country’s first sovereign wealth fund aimed at generating more public funds.

“We expect Marcosian maneuvers for the President himself to assign friends and cronies to handle half-a-trillion worth of people’s money under this Maharlika Scam,” said Andres.

Marcos, however, insisted the fund would be transparent and only top finance professionals would be hired to manage it. “I assure you that the resources entrusted to the fund are taken care of with utmost prudence and integrity,” Marcos said.

Maharlika Investment Corp. is set to receive a minimum of P75 billion in paid-up capital this year. The Land Bank of the Philippines and the Development Bank of the Philippines will contribute P50 billion and P25 billion, respectively.

The national government will provide P50 billion from the dividends of the Bangko Sentral ng Pilipinas, and for the first two years, all declared dividends of the central bank will go to the fund. The dividends will be divided equally between Maharlika’s funding and the BSP’s capitalization.

The government’s 10 percent share from the Philippine Gaming Corp. will also contribute to the funding. The capital stock will be P500 billion, consisting of 5 billion shares priced at P100 each, with 3.75 billion common shares and 1.25 billion preferred shares.

Critics lamented that instead of using taxpayers’ money to fund social services and projects, it will be used as a stockpile fund for the MIF.

Public funds must not be gambled, especially that any losses from this Maharlika scam will be shouldered by the people and any wins will be raked by Marcos and his cronies,” said Andres.

The word “maharlika” is widely associated with Marcos Jr’s late dictator father and namesake, who presided over widespread human rights abuses and corruption during his two decades in power. He was ousted in 1986. – with reports from Agence France Presse